Let's start with a paradox in the form of a question: Why do US markets go up when Biden's probability of winning goes up? Conversely, why did Trump's Coronavirus infection drag the markets down when it was announced? Let us examine the different aspects of potential market impacts and what seems to be already integrated into the formation of price and market expectations. Let us keep a simple idea in mind: the market scenario that we can rationally anticipate does not necessarily occur, quite simply because it is usually already priced in, and the lifting of uncertainty can sometimes produce a rebound regardless of the outcome. Beyond preferring one candidate to another, markets hate uncertainty above all else, and may be integrating only progressively the potential impacts of tax reforms that could result from a Biden victory (as was the case in 2016-2017).

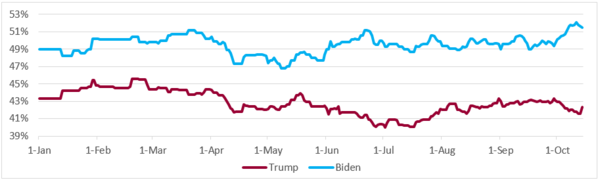

General US election - National polls average

Source: Realclearpolitics, Indosuez Wealth Management

1. What should theoretically be the expected market impact of the different electoral scenarios?

In theory, we can draw the following impacts of the different scenarios:

- Biden victory without a majority in the Senate: a constructive scenario for the markets, which anticipate a fiscal stimulus, without however fearing strong tax increases in the absence of a majority; this scenario would be rather favourable to cyclical stocks, to renewable stocks and the turnover may increase;

- Biden victory with a majority in the Senate: more negative for equities due to corporate tax hikes in the economic program. A Senate majority makes these hikes more likely;

- Trump victory: continuity with the current framework: in comparison to a Biden scenario favourable to companies most exposed to an increase in taxes (such as technology) or environmental (such as energy) or financial regulations (banks);

- Contested scenario: negative for equity markets throughout all sectors, increasing volatility; scenario favourable to safe-haven securities such as the dollar and treasury bills (with uncertainty about the behaviour of gold if the dollar rises).

The main problem with this analysis of market reactions is that everything also depends on how the markets are positioned before the event, as the 2016 precedent attests. The other limitation is that the forecasts carried out on the sectoral level 4 years ago have been foiled (see below).

2. What lessons can be drawn from the 2016 precedent?

Two lessons from the previous election may be useful to investors today:

- First, contrary to what most analysts predicted, the election of Trump did not lead to a cataclysm in the markets, but on the contrary to an upwards acceleration; this shows that the importance of hedging;

- Second, in the longer term the initial forecasts of equity strategists have also proved to be partly inaccurate. A Trump victory was supposed to be favourable to the energy sector and banks, due to the deregulation posture. However in the end it is technology (supposedly penalized by funding from Hillary Clinton's campaign) which dominated everything else and also benefited from the tax reform passed in early 2018.

3. What is the link between recent polls, news and market trends?

Three phenomena are interesting to observe:

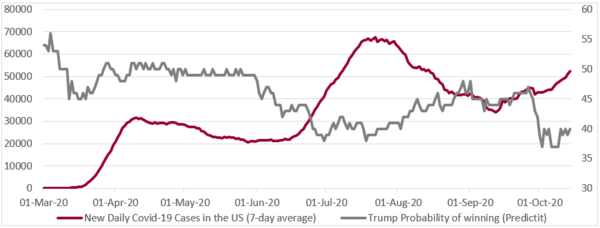

- The inverse correlation between the Covid-19 infection curve and favourable opinion polls for Donald Trump

Trump polls and COVID-19 cases

Source: Bloomberg, Indosuez Wealth Management

- The correction of markets during the announcement of Donald Trump's Covid-19 infection, and vice versa upon his return

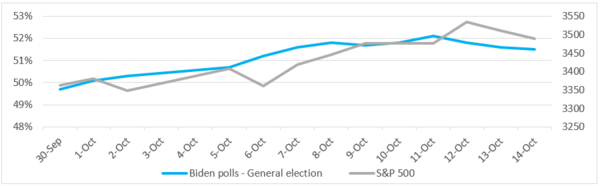

- The rise in markets that continues in conjunction with the rise in Biden's lead

Biden Polls and S&P 500

Source: Bloomberg, Indosuez Wealth Management

This last point raises a double question as on the one hand it seems to reflect a contradiction with the previous point (the market’s correction with Trump's Covid-19 infection and rise with Trump's recovery), and on the other hand, because it may reflect an evolution of the decisive factors behind the markets.

Our reading of this phenomenon is as follows:

- More than the name of the candidate supposed to win, it is the level of uncertainty that generates volatility

- The more assertive a Biden victory scenario (even though it may induce a Democratic majority in the Senate) the more it reduces the likelihood of a contested scenario decline, which supports the market. This point is confirmed by the rise in volatility in US equities on October 2 and the (albeit moderate) decline in volatility since.

We can nevertheless complete this view with the following two points 4 and 5.

4. US Elections or Stimulus: which factor dominates equities and fixed income markets?

Over the past two weeks, the dominant factor in equity markets appears to have shifted from the election deadline to speculation about the prospect of a stimulus package, on which Trump's reversals largely explain the bullish or bearish moves (see chart). This subject may lead to relativizing the election scenario insofar as the two candidates push for an extension of budgetary support: only the scale of the plan and its allocation differentiate them. Beyond a surge in equities, the rise in expectations of a stimulus plan fuelled as much by Trump's tweets as by discussions between Steve Mnuchin and Nancy Pelosi is reflected in a steepening of the yield curve, a sector rotation and a fall in the dollar. This last point is quite revealing given that the US currency behaves in the very short term as the barometer of the level of risk appetite (which can be insightful on the behaviour of the dollar depending on the scenarios).

5. Options markets nonetheless reflect the importance of protection strategies

To conclude that the markets have completely turned away from the elections to focus solely on the stimulus plan would however be exaggerated. We are in fact in a situation where:

- Cash equity markets seem to praise (perhaps too much) an accommodative scenario (a stimulus plan, a decrease in the probability of the contested scenario, a Biden victory without tax reform)

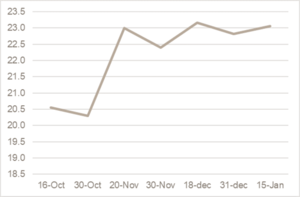

- Options markets reflect a strong search for protection until mid-December, with high implied volatility:

Implied volatility of put options at the money S&P 500 (3490 pts)

Source: Bloomberg, Indosuez Wealth Management

This undoubtedly reflects the following positioning of investors: a constructive central scenario for equities, but a search for protection in an alternative scenario with a lower probability, but with a significant negative effect.

Beyond the elections, three other explanations can be put forward for the level of equity volatility which is not weakening:

- a sector rotation which increases the level of dispersion;

- a lot of contradictory signals on the chances of a stimulus plan;

- long-only managers who have massively played on the performance of technology and perhaps seek to secure their relative performance by neutralizing themselves with the help of options.

6. Are the markets underestimating the impact of higher corporate taxes?

This is probably the aspect that poses the most questions today: Biden's strong lead in the polls does not make equity markets cough when one could also infer an increase in the probability of a Democratic majority in the Senate and therefore tax reform. Therefore, this risk is probably underestimated and could justify the implementation of strategies in this direction.

How should we understand this underestimation? A first interpretation: the market do not believe in Biden's ability or willingness to pass a corporate tax hike, or at least on the scale planned. A second explanation: the negative effects of a tax increase (lower than that of the program) could be compensated by the positive stimulus effects and the lower probability of a contested outcome.

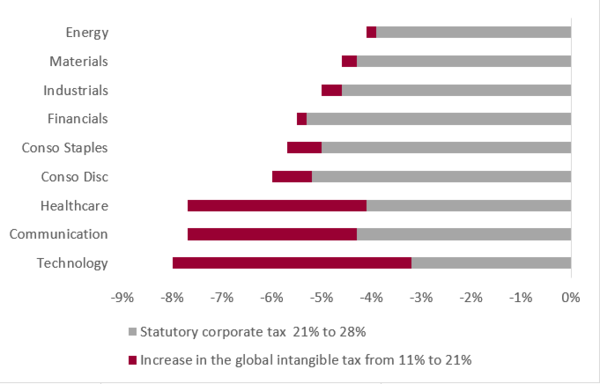

7. Which sectors would be the most penalized by a tax hike?

If we include both the effect of increases in activity generated by a stimulus plan and the effect of tax increases, the effect is relatively asymmetric (see graph): technology would be the most penalized sector, conversely, industry, energy and basic materials would be less affected (source: Goldman Sachs).

EPS impact of Biden corporate tax reforms

Source: Goldman Sachs, Indosuez Wealth Management

This effect is further amplified by the steepening of rates, which is favourable to cyclical stocks and unfavourable to long duration stocks such as growth stocks.

In the short term, the technological sector may underperform, but it is advisable to take a step back and see that deep structural changes continue to fuel their exponential growth.

8. Is the dollar Republican?

The victory of Trump had led to an appreciation in the US dollar reflecting a reflationary movement and expectations of rate hikes. Conversely, an election of Biden with a Democratic majority in the Senate, if it were to provoke a movement of risk appetite, would probably result in a fall in the dollar initially, especially in a context of anchored rates for at least the next two years. What about other scenarios? Should we concur a link between Trump and the dollar?

If Trump wins, we can expect a positive reaction from the equity markets, and therefore more of a bearish movement in the dollar unlike 4 years ago. Conversely, a Biden victory in the Democratic Senate would perhaps signify a risk aversion and rising dollar reaction, as would also be the case for a contested scenario.

9. Will gold behave like a currency or a safe haven?

The previous point about the dollar is decisive for the behaviour of gold. Indeed, in recent months, gold has behaved no longer as a safe haven, but as a currency inversely correlated to the dollar. This was the case during the market shock of last March when the dollar rose sharply and gold corrected, it was the opposite case in the following months with a weakening of the dollar and a rise in gold, which also justifies a dramatic cut in interest rates.

So logically, if gold were a safe haven, it should rise in a contested scenario, but if its inverse correlation to the dollar is maintained, its stability can be expected at best. Unless we change the interest rate regime and the correlation regime, we believe that gold should remain inversely correlated to the dollar in the short term, while remaining very sustained in this phase of low rates. In the medium term, our view of a moderate fall in the dollar is accompanied by a constructive view on gold.

10. Should we position ourselves before the elections?

The main trap for investors would be to sell the markets in this uncertain phase only to buy them back once the political uncertainty is lifted. This is especially the case if the scenario of a contested election sees its probability decline. In a way, private clients capable of projecting themselves beyond the event and of supporting volatility, have almost an interest in navigating against institutional investors, who being forced to manage volatility peaks, sometimes hedge this type of event.

However, depending on the initial positioning of each investor and the scenario they wish to cover, we believe that live options or structured products are good instruments for either monetizing uncertainty by selling options or alternatively setting up strategies to protect pre-existing positions to hedge a very degraded scenario.

October 16, 2020