The Q4-21 earnings season in the US

Can the bottom-up offset the top-down macro stress?

5 messages to remember

- The Q4 earnings season is more advanced in the US than in Europe.

- So far, numbers are encouraging with more than 75% of companies beating estimates.

- However, profit margins are below Q3-21 level and guidance on the 2022 outlook is mixed.

- The key concern remains margin sustainability, with the impact of cost inflation on a larger number of items and on a more widespread scope of sectors. This season led to a negative revision of Q1-22 earnings.

- This earnings season - as it stands - also confirms 2 points :

- in the long run, there cannot be a disconnection between the macro picture on inflation and what can be seen in earnings: if PPI remains higher than CPI, margins will be pressed unless productivity gains explode

- the earnings season confirms our “barbell strategy” pushed since November 2020, focused on Value and Quality growth, with a strong focus on profitability and cash flows in 2022

6 key take-aways from this earnings season

1. A strong level of revenue & earnings growth

Regarding the S&P 500 companies which have published so far (56% of S&P companies as of February 4th), average revenue growth year-on-year stands at 15%, well above the 5-year average growth rate of 6.5%. We do not expect this performance to be repeated in 2022.

Indeed, some sectors have recorded skyrocketing revenue growth, such as energy (at +88% YoY). We can also quote several industrial sectors such as Metals & Mining (+51%), Construction (+29%) and Chemicals (+27%).

Looking to the bottom line, Q4-21 average earnings growth published to date stands at 29% year-on-year, well above the 5-year average of 14%. The return of strong profits in the energy sector (vs. losses in 2020) as well as in the industrial sector (+90%) has been spectacular even if earnings in the energy sector were below expectations.

2. A strong level of positive surprises on revenues and earnings

Overall, the ratio of positive surprises remains elevated, and that is good news given the record level of positive revisions already recorded in 2021. Overall, 77% of US companies that have published their results are beating revenue expectations, just above the long term average of 68% (US companies have always done a good job of managing expectations). In terms of earnings surprises, 76% stand above expectations, in line with the 5-year average.

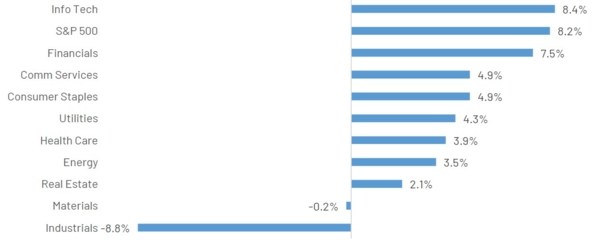

The magnitude of EPS beats stands at 8.2%, slightly lower than the long term average of 8.6% EPS growth beats. The degree of positive surprises confirms our preference for Value on the one hand and technology stocks on the other hand (see chart 1). These surprises are explained by the strong numbers published by US banks at the beginning of the season, and more recently by Apple, Alphabet, Microsoft, AMD and IBM, as well as energy stocks such as Exxon. However, there are some disappointments to be underlined in these sectors, as reflected by Meta Platforms (parent of Facebook for which results came out below expectations with a weak guidance for Q1-22) and Chevron.

Chart 1: S&P 500 Sector Level Earnings Surprise Q4-21 (excluding consumer discretionary sector)

Source: Factset, Indosuez Wealth Management

The situation is more mixed in sectors such as healthcare (notably Gilead below expectations, and mixed response to Merck&Co guidance despite good results) and industrials, where margin pressure is felt and has affected guidance.

The energy sector is overall below expectations on earnings, but significantly above on revenues, and was able to report 88% revenue growth vs. Q4-20 on an aggregate basis.

Unexpectedly, the staples sector (expected to be affected by margin pressure & input costs) surprised positively on earnings, probably thanks to better revenue growth (2.3 percentage points above expectations), which could offset lower margins.

3. The sector hierarchy is unchanged for earnings growth vs. 2020

If we put aside the level of surprises, but just focused on year-on-year earnings growth, the best sectors so far remain energy, industrials, materials and technology. That is explained by strong revenue growth on energy, materials and technology, but even more so by higher margins than last year on industrials. In this last sector, there are also some specific stories on the aerospace sector which explain this rebound (airlines and Boeing). Consumer discretionary earnings growth is boosted by Amazon reinforced by an exceptional $12bn valuation gain.

The worst sectors so far from an earnings growth standpoint are utilities and staples, where valuation metrics are also negatively correlated to long term rates, putting a double downward pressure on these sectors. Utilities suffer both from a weaker than expected revenue growth as well as slashed profit margins.

4. Changes in profit margins versus Q3-21 send a different message

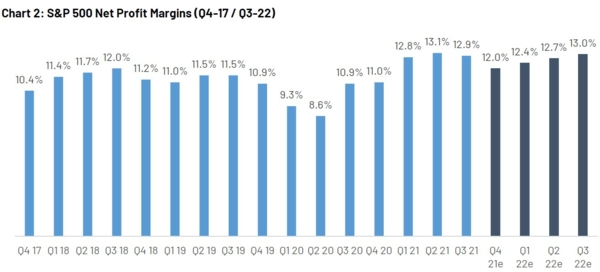

Things are a bit less positive when we start to dig into the change of profit margins since Q3-21 and when we look into the company guidance for 2022, which could lead to an inversion of the earnings revision cycle.

The aggregate profit margin of S&P companies that reported is going down (from 12.9% in Q3 to 12%): even if this seems only a small difference at first sight, it is in fact important, and it raises questions for the upcoming quarters (see chart 2).

Chart 2: S&P 500 Net Profit Margins (Q4-17 / Q3-22)

Source: Factset, Indosuez Wealth Management

From this perspective, technology, financials, materials and energy have done relatively well, with profit margins at elevated levels (technology and financials) and / or in progression (technology and energy 4 points above their 5-year average profit margin).

On the contrary, utilities have taken a big hit with profit margins down by 6.2 points, while consumer discretionary and industrials lose respectively 1.8 and 1.6 points of profit margins.

This suggests a rotation within the Value theme from Cyclicals towards reflation sectors (banks, energy and materials).

The explanation for these lower margins in a context of generally healthy revenue growth lies in the rise of costs, either on the input side (energy, raw materials, shipments) or on the wage side, even if some sectors have also been affected by disrupted supply chains in their top-line growth, notably the auto sector.

It is probably too early to comment on statistics on guidance with limited number of companies that have delivered elements on their outlook, but overall the proportion of negative guidance is higher than usual (72% instead of 60%), and the qualitative message passed by cyclical companies is an increasing or longer than expected pressure from rising costs, which raises the question for the FY 2022 outlook.

5. Can we expect a rebound in profit margins as the consensus still expects it?

Nowadays, the consensus expects profit margins to rebound steadily towards 13% in the third quarter of 2022,

i.e. the recent peak of profitability seen in Q2 21. Is this assumption reasonable and what does it rely on given the mixed messages coming from corporate guidance?

If we look at expectations on Q1-22 earnings, energy is the most noticeable sector with positive revisions year- to-date. Most of the other sectors are flat and industrials have negative revisions.

The negative point is that EPS growth expectations for Q1-22 have been revised down during the earnings season by 0.7%, largely due to the industrial sector. It is quite typical to have these negative revisions on Q1 expectations, notably if on average negative guidance is structurally above positive guidance, but this is the first decrease of EPS estimates since Q2 2020.

Nevertheless, several sectors were revised positively such as energy and technology. On the contrary, EPS for Q1-22 have been revised negatively for industrials (-10%). Utilities, staples and materials have also been revised negatively.

On a full year basis, consumer discretionary is expected to lead from a revenue growth standpoint at 14% while on the earnings side, industrials and energy, technology and healthcare are being revised positively since the beginning of the year.

While Q1-22 expectations are close to Q4-21, quarterly growth expected in Q2 and Q3 is far from being low bar ; Q2 consensus EPS for the S&P 500 is 6.5% higher than Q1-22, and Q3-22 is 5% higher than Q2-22; that is 23.8% annualised growth between Q1 and Q3. Q4-22 expectations are, however, in line with Q3-22.

Therefore, there are probably some risks on this earnings growth path in cyclical sectors, if growth disappoints or if energy costs remain high and wages continue to rise. There may also be some limitations to repricing potential vis-à-vis end consumers from a purchase power stand point.

The positive surprise could come either from financials (where earnings growth expectations are negative for 2022), from technology (10% earnings growth for 10% revenue growth means a very conservative assumption on operating leverage). It could also come from external demand, notably if the dollar weakens in the second half, which could be positive for multinationals with a strong contribution from revenues in other currencies.

6. Market reaction to positive vs. negative news is more asymmetrical than usual

On average, share prices of companies that reported above expectations have only progressed by 0.3% (vs. 0.8% historically) while those that disappointed see their share price going down by 3.3% (vs 2.3%).

Conclusion

At this stage, the beginning of the earnings season confirms so far several important investment messages underlined in our recent publications and client events (CIO Brief held on January 31st):

- This earnings season remains a supportive factor that has contributed to the market rebound in the past few days, but investors will continue to closely monitor the revision trend which is turning negative

- We maintain a preference for reflation/Value stocks and profitable technology

- We believe that the rotation within Value (from cyclicals to reflation) and within technology (from hyper- growth to profitable growth) should continue

- We see signs of weaknesses in the profitability level of several sectors reflected by corporate guidance, and we think that the key theme of 2022 will be profit margin sustainability and cash-flow generation

February 07, 2022